A Guide to to Stocks, Convertible Notes and Valuation

Introduction

Starting a startup? Feeling overwhelmed with terms like stocks, preferred stock, options, and convertible notes? You’re not alone. Many articles discuss these topics, but most are not beginner-friendly. That’s why today, we’re going to simplify the complex world of startup investment and dilution.

Raising Capital: What It Means and Why Convertible Notes?

When your tech startup is seeking financial fuel to grow, the process is known as “Raising Capital.” For early-stage startups, the go-to method is often raising capital via Convertible Notes. It’s the quickest and simplest way to get investment funds transferred to your bank account. Read our complete guide on Convertible Notes here. But, what happens to your company’s structure when you raise capital? To get that, let’s understand how Stocks and Equity function.

Understanding Stocks and Equity

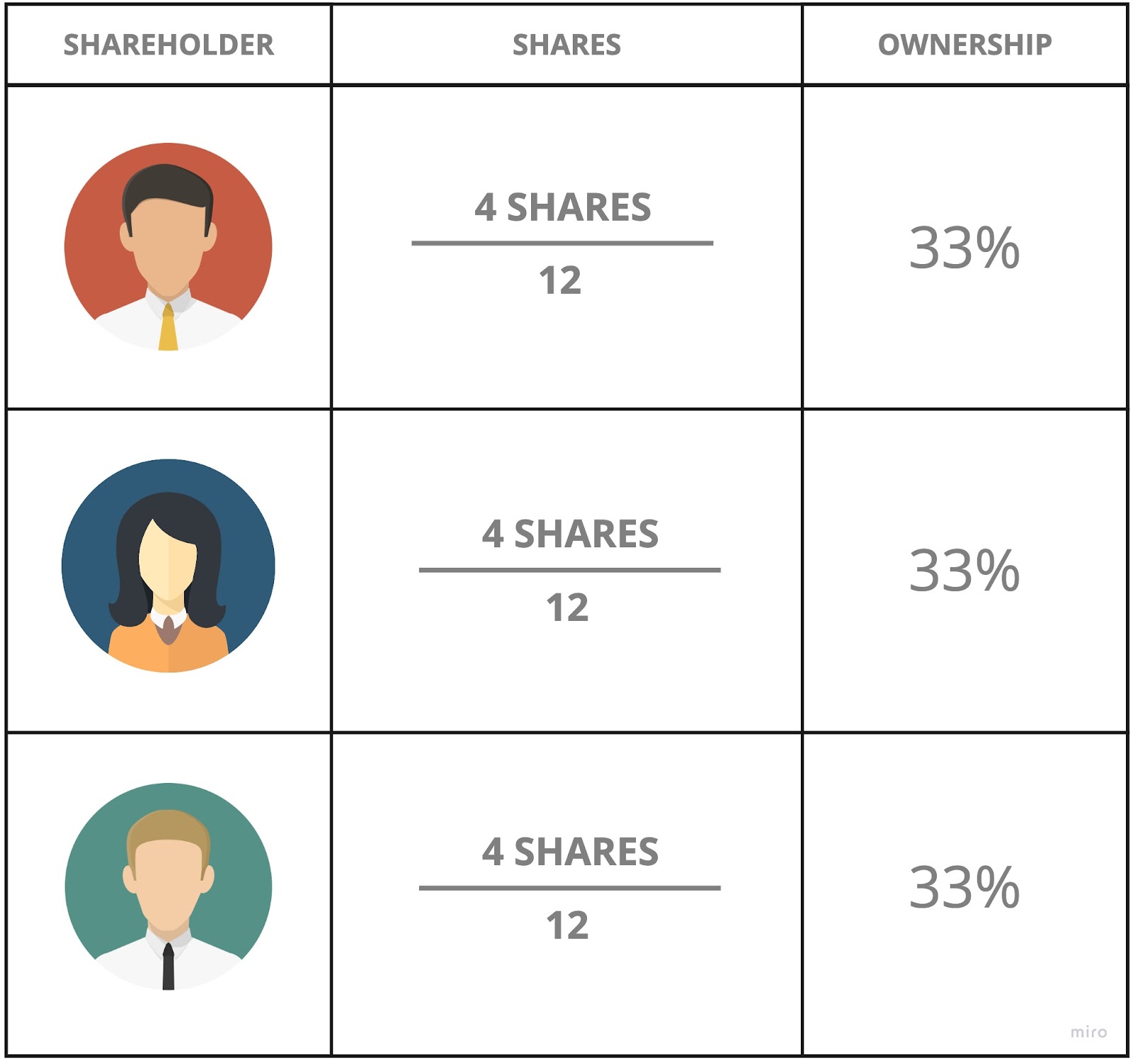

Stocks, also known as equity, signify company ownership. These are divided into shares to represent each shareholder’s ownership percentage. The ratio of shares owned by a shareholder to the total shares issued reflects their stake in the company.

You can acquire stocks either through cash investment or sweat equity—that is, hard work and contributions to the company. This ownership usually dictates your share of company profits (known as dividends) and your voting power in key company decisions.

Example: Meet Shadi Mubarak

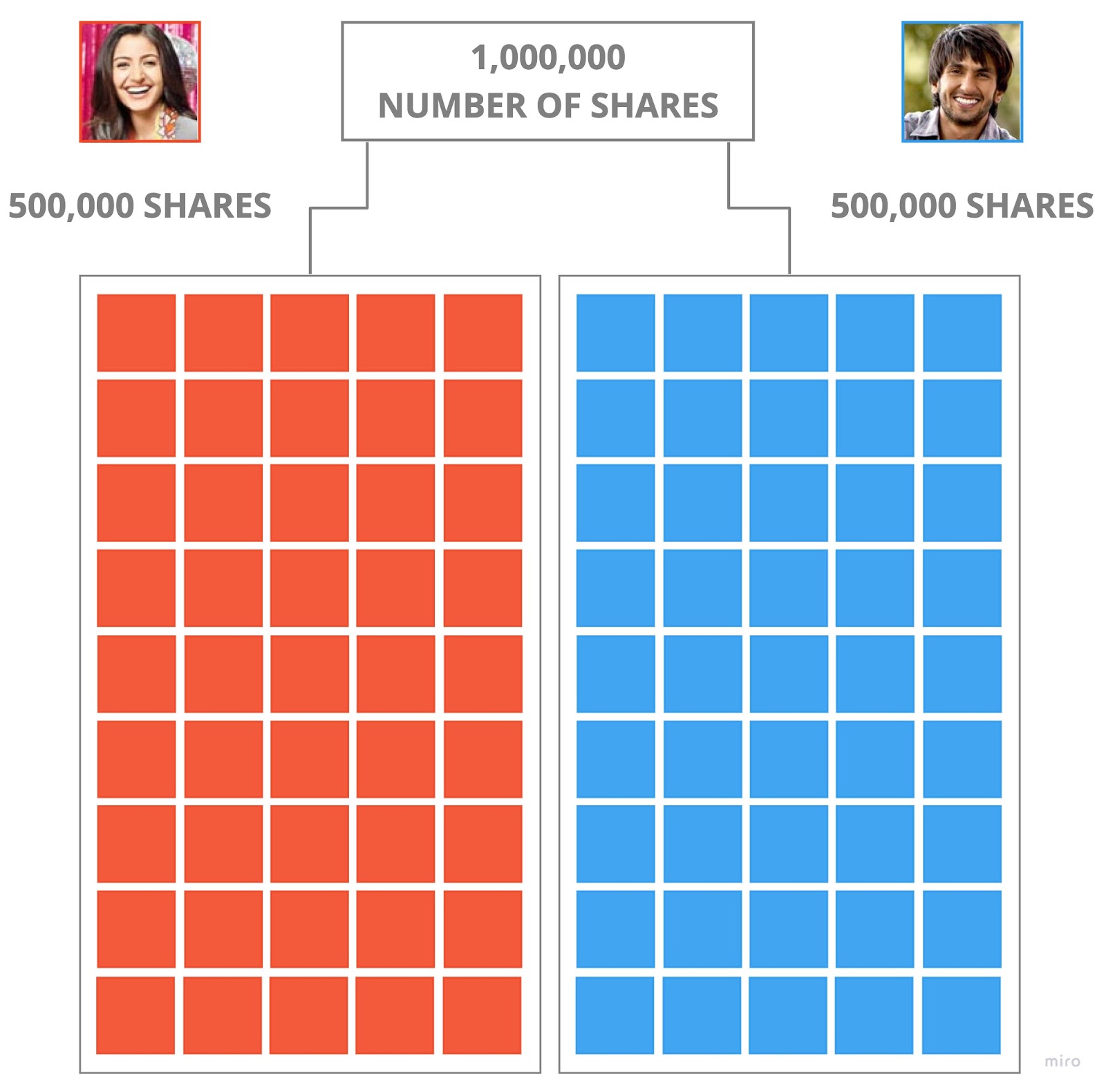

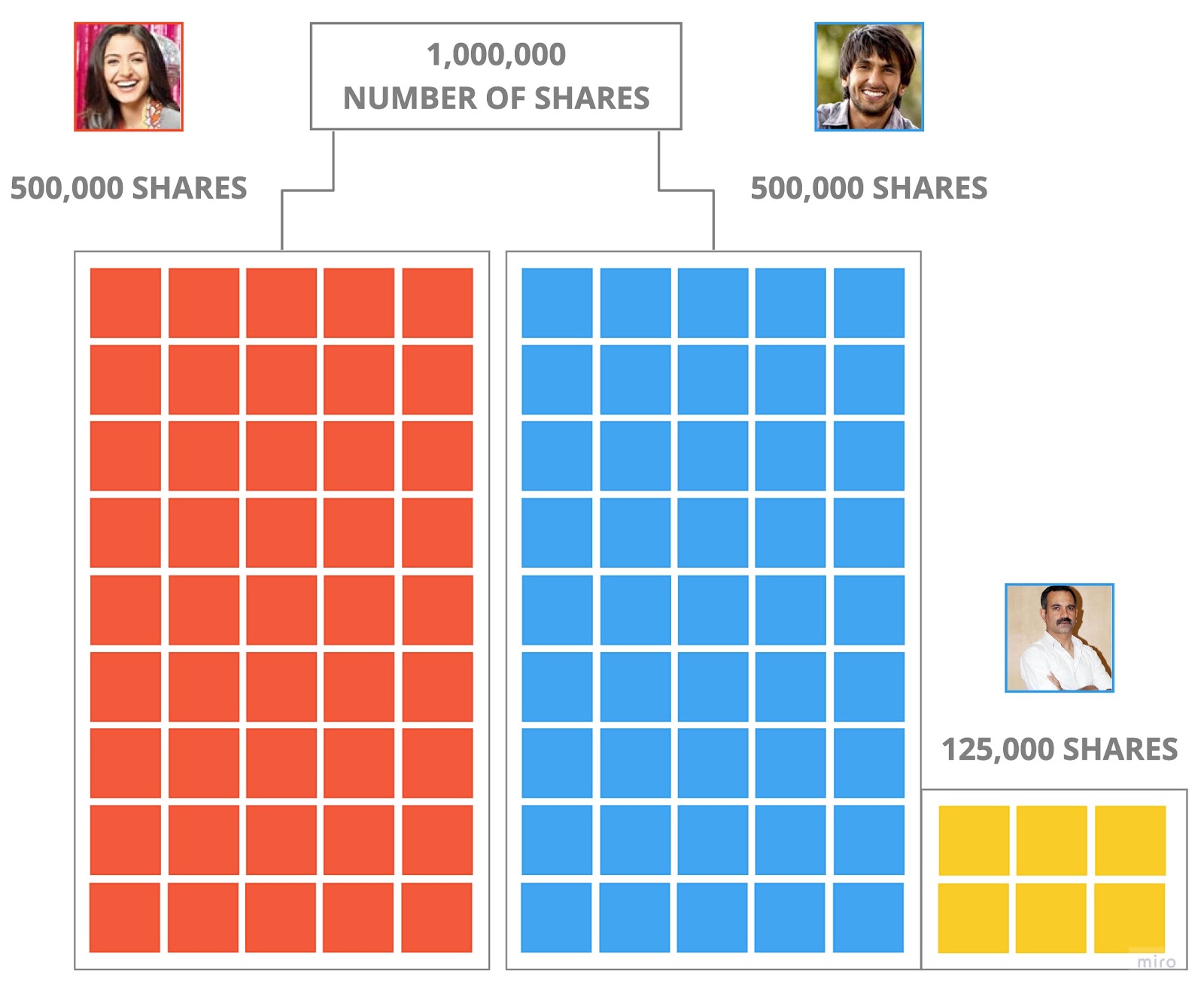

Imagine a company named Shadi Mubarak with two founders: Bittoo and Shruti. Both have invested their time and skills equally. The company has 1 million shares, with each founder holding 500,000. The more shares, the easier it is to divide ownership, as we’ll explain later.

Fundraising: The Priced Round Method

In a priced round, founders and investors agree on the company’s valuation. The investor then receives shares corresponding to their investment amount.

For example, let’s assume Shadi Mubarak generates $25,000 in monthly sales and needs a $500,000 investment for growth. The company’s valuation is estimated at $4 million based on its future potential (as often is the case with tech startups).

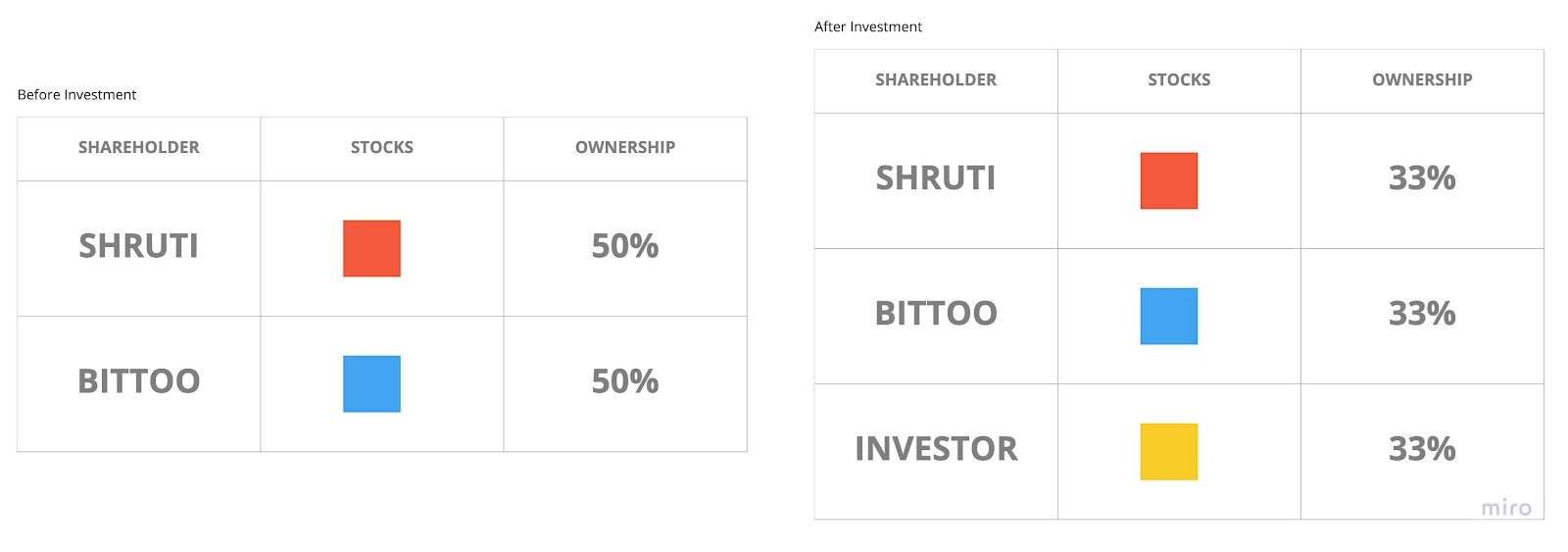

How Dilution Works

Founders usually issue new shares to the investor, diluting their own ownership. For instance, if two founders each own one share, they both have a 50% stake. But, when a third share is issued to an investor, each founder’s ownership dilutes to 33%.

The Math Behind Shares and Dilution

If Shadi Mubarak’s 1 million shares are worth $4 million, the investor would receive:

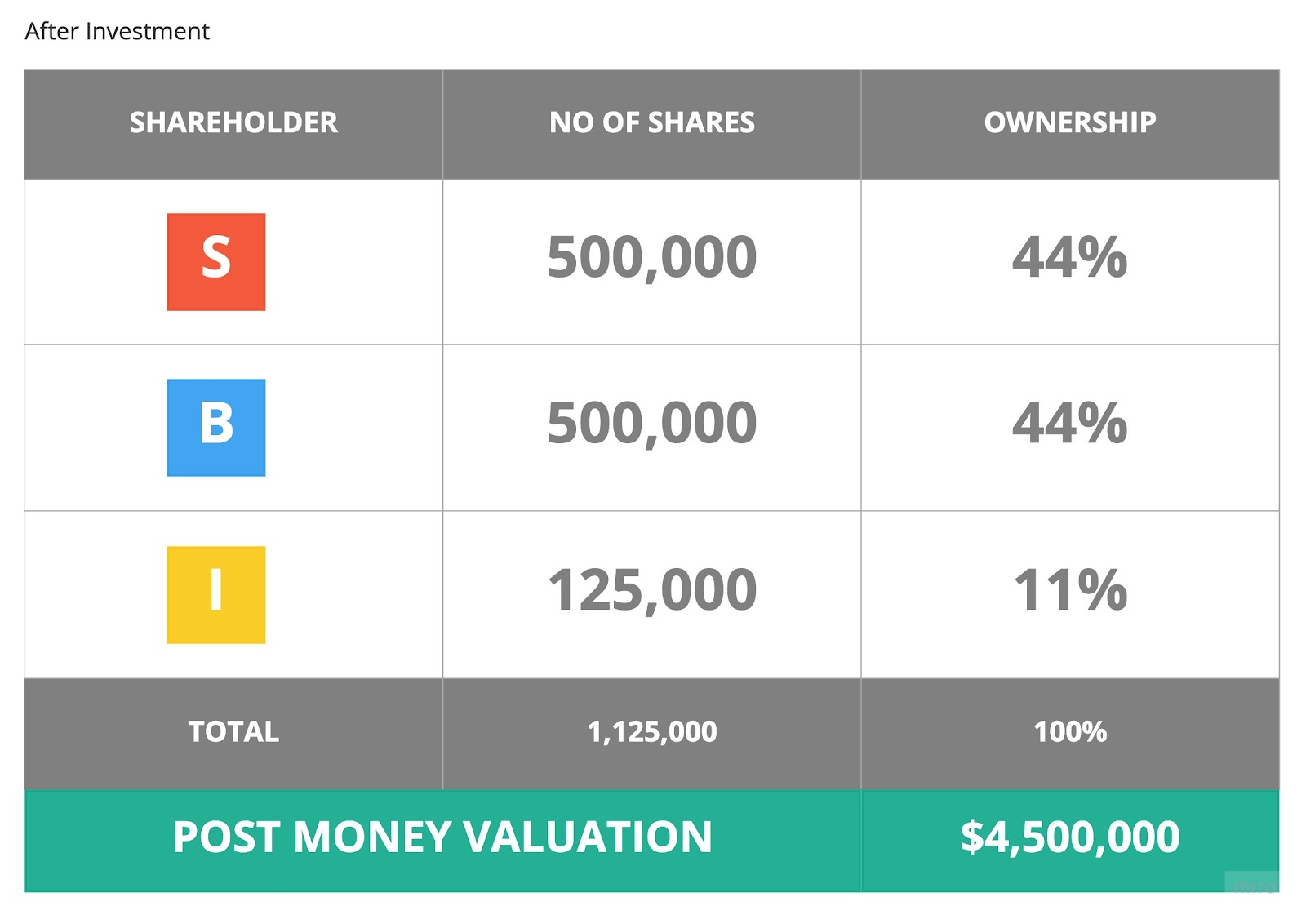

The total number of shares would now be 1,125,000, thus diluting the original owners’ stakes.

This is how the new company share structure would be after the priced round,

Why Start With 1 Million Shares?

Why not start with just 100 shares? Well, small percentages may seem trivial early on, but as your company grows, even a 0.01% share can become valuable. For example, a 0.01% stake in Uber is now worth $8 million. Having a large initial number of shares makes it easier to distribute ownership minutely.

Conclusion

Understanding investment and dilution is crucial for any startup. While the process might appear complex, it’s integral for your company’s long-term financial health. Still have questions?

One of the best piece of content I read on fundamentals of raising a capital. Neat and smooth for a layman.